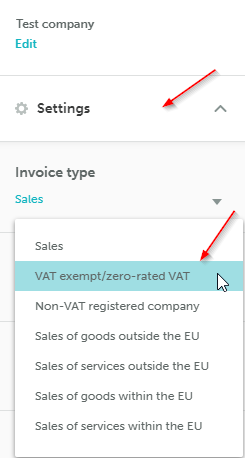

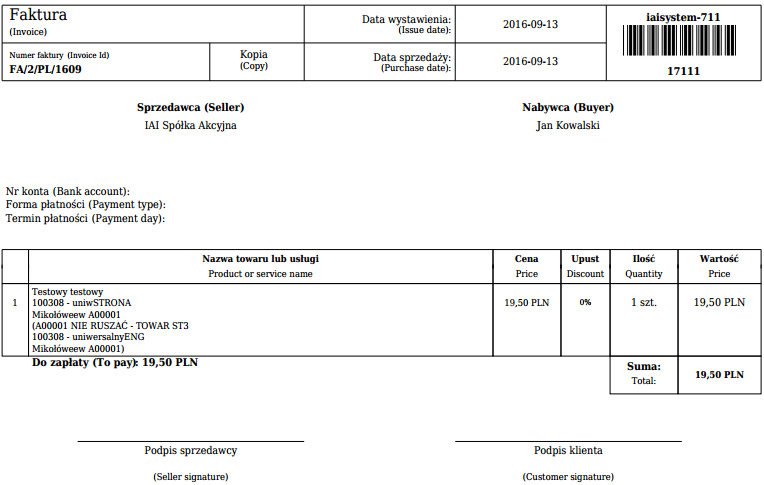

We facilitate conducting sales exempt from VAT e.g. by adjusting the way of generating sales documents and settling orders. - IdoSell

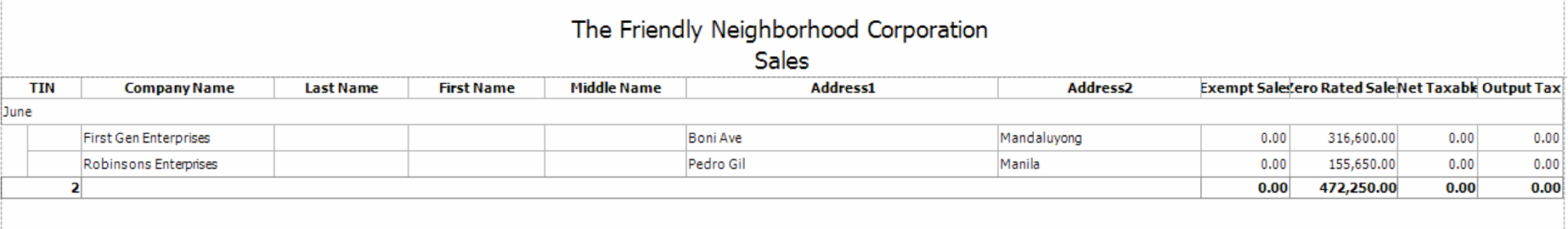

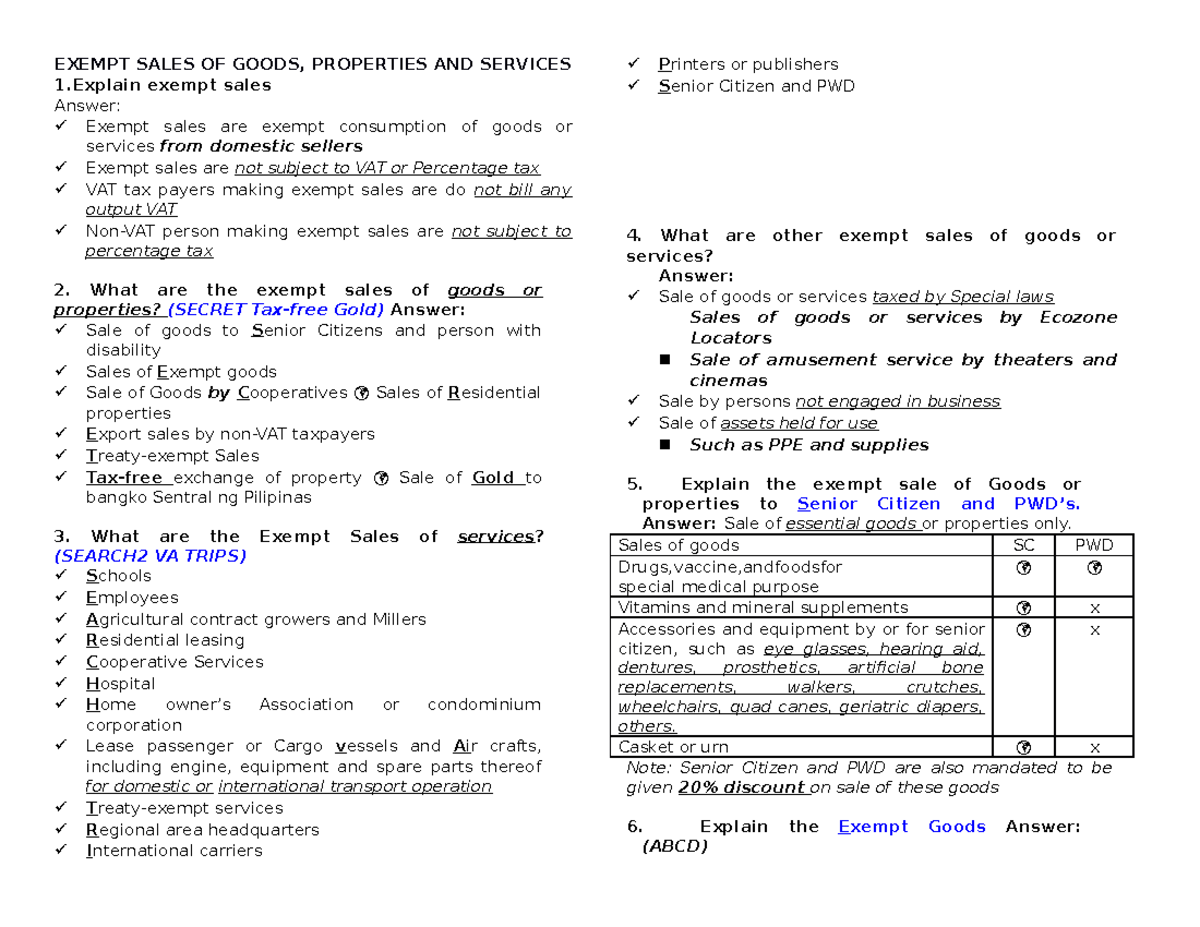

Exempt Sales OF Goods - Business taxation summary - EXEMPT SALES OF GOODS, PROPERTIES AND SERVICES 1 - Studocu

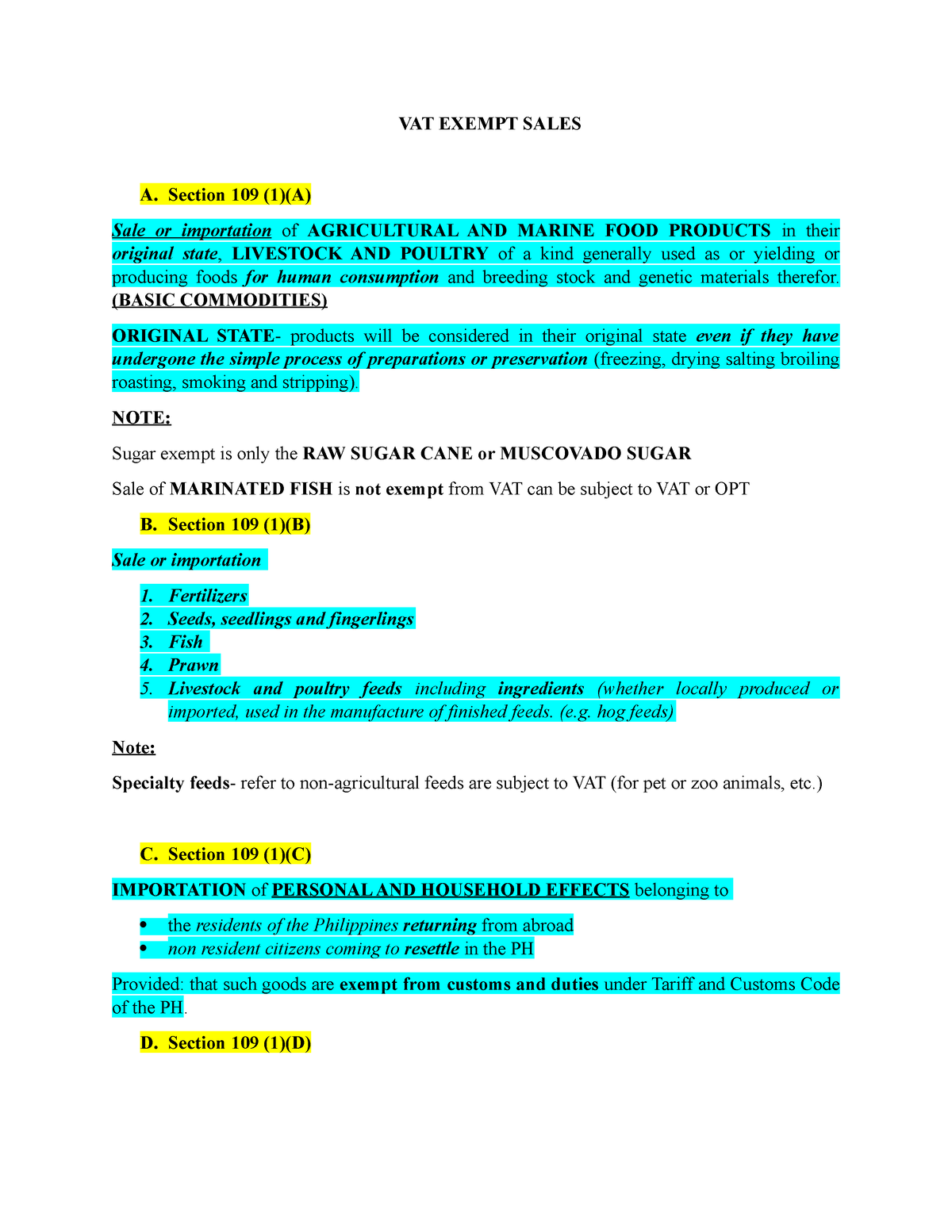

VAT Exempt Sales - VAT EXEMPT SALES A. Section 109 (1)(A) Sale or importation of AGRICULTURAL AND - Studocu

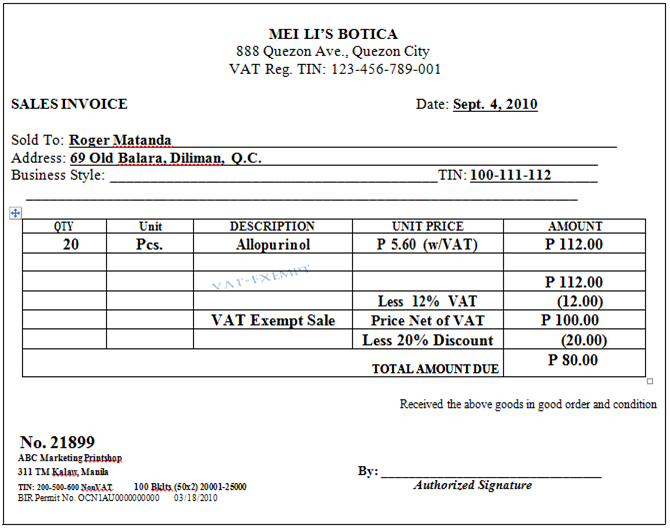

Official Website Of Cavite City - Question and Answers Further Clarifying the Provision of Revenue Regulation (RR) No. 7-2010.

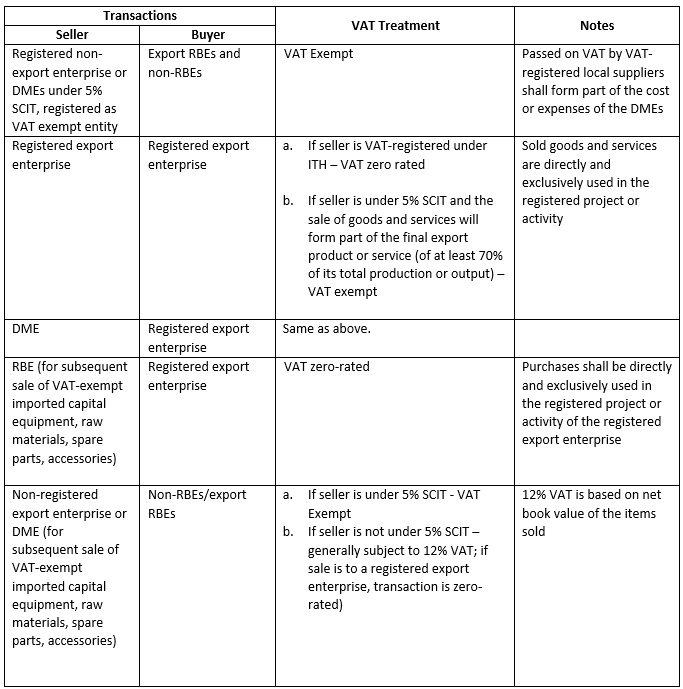

Clarifications on the VAT rules for Registered Business Enterprises (RBEs) under the CREATE Law | Grant Thornton

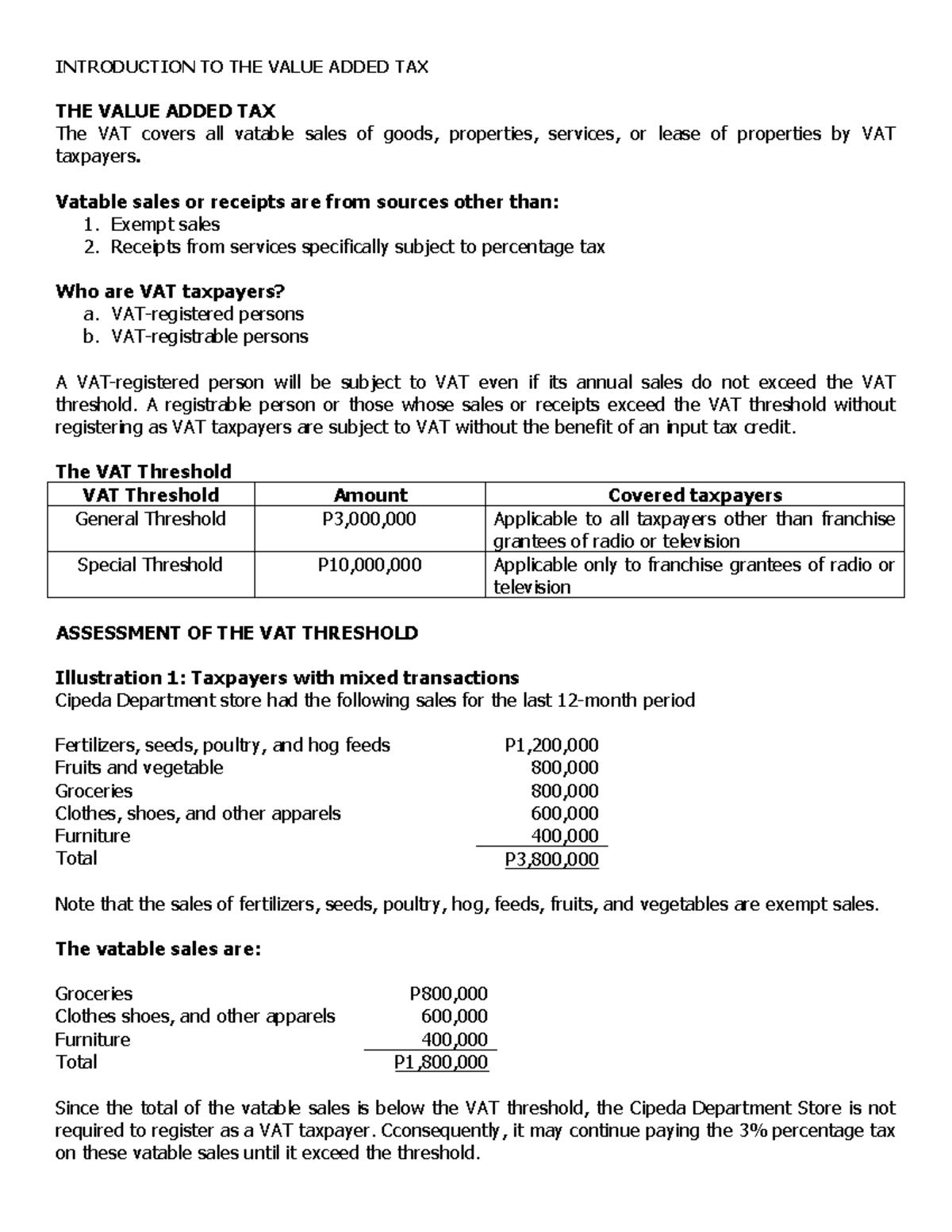

6 - tax - INTRODUCTION TO THE VALUE ADDED TAX THE VALUE ADDED TAX The VAT covers all vatable sales - Studocu